Our Solutions

Solutions

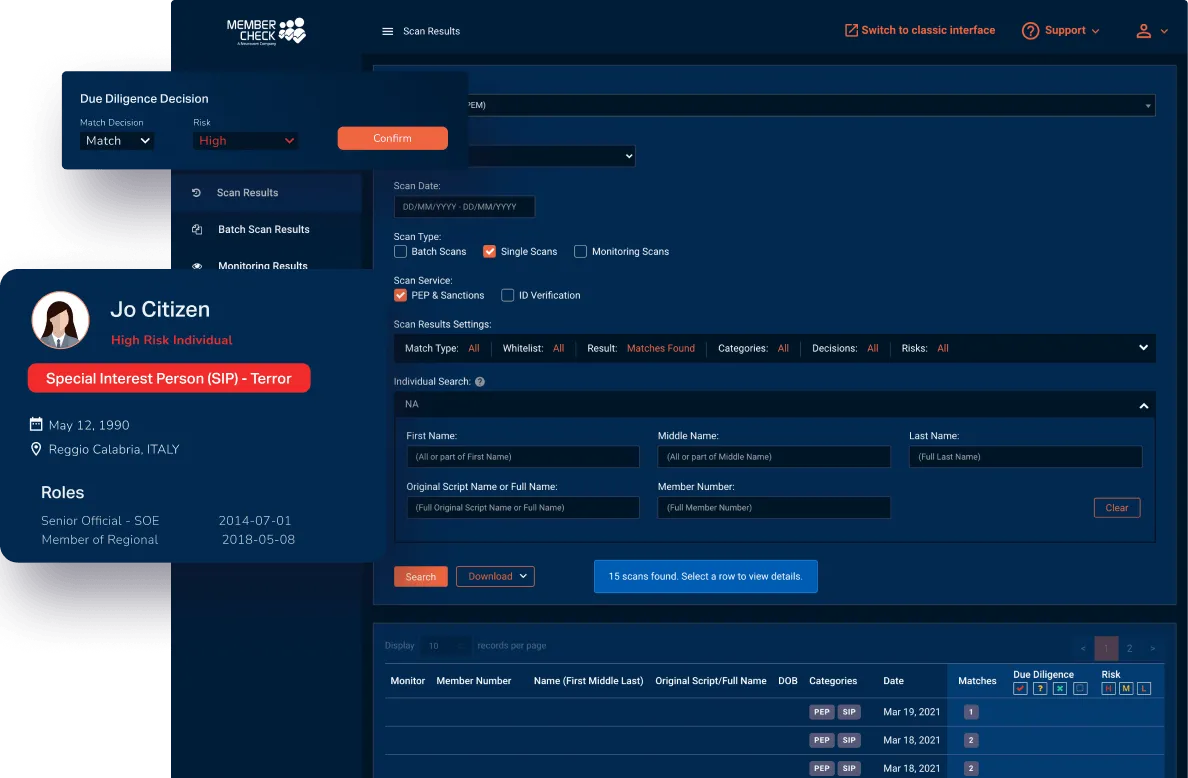

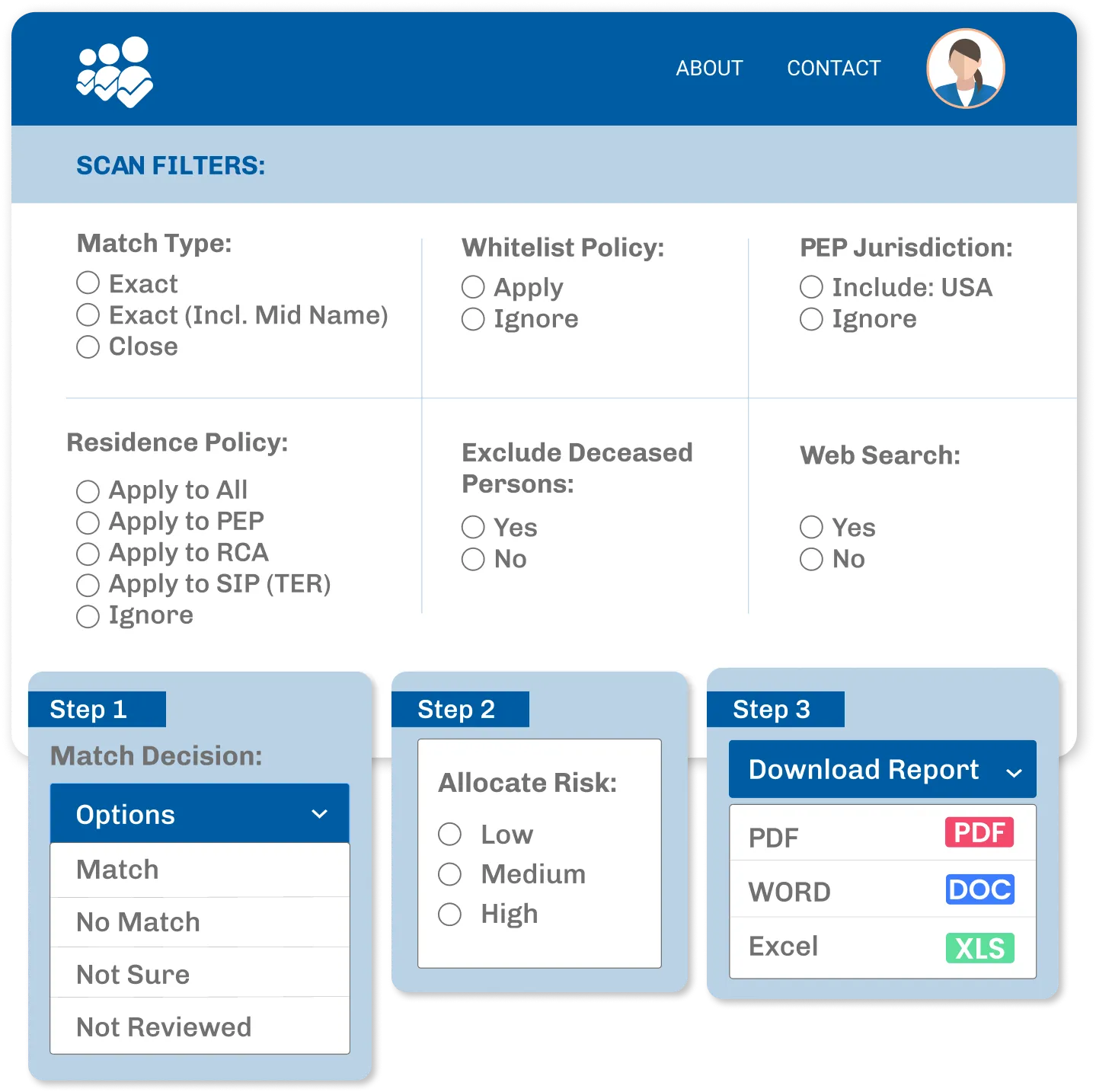

PEP and Sanctions Check

Adverse Media Check

Customer Identity Verification

Know Your Business (KYB)

Enhanced Due Diligence

AML Consulting Service

Compliance as a Business (CaaB)

Transaction Monitoring

Jurisdictional Risk Checks

Our Coverage

Pricing

Blog

About

Contact Us

Sign In